Monitor Reviews

Step 3. Engage an External Monitor Reviewer as a Risk Management Tool

A monitoring review package includes an Ongoing Policy Monitoring Review for a 1-year period and a Completed File Review. In the past, monitor reviewers have only been able to help you identify where the problems are. Not only will we help to identify deficiencies that inspectors would focus on, and we will also help you identify areas that your audit team can spend less time on. We will ignore problems that, in our experience, a inspector would also ignore.

Original Price: HK$30,000

External Monitor Reviewer

You may wonder, what good would hiring a monitor reviewer bring to my firm, as he/she would be hired to identify deficiencies which in turn may get me penalized. Hence, you may also be skeptical whether or not the Inspectors would penalize you for these deficiencies.

Well, the answer would be a solid NO. In fact, it is quite common for CPA practitioners to shy away from monitor reviewers for fear that the findings they have generated may adversely affect the inspector’s impression on them. This is a common misconception because in actuality, inspectors would actually WANT you to rid yourself of petty deficiencies in order to improve your firm. So our advice is to go ahead and hire that monitor reviewer as your first step!

But what would a monitor review encompass?

A monitor review typically consists of two key parts; Ongoing Policy Monitor (OPM) Review and Completed File Monitor (CFM) Review.

In an OPM Review, the reviewer places emphasis on your firm’s quality control and compliance with the Quality Assurance Manual, meaning that he/she will review your Firm’s / practitioner’s compliance with internal controls such as procedures of client and engagement acceptance, anti-money laundering procedures and monitoring of engagement performance etc.

On the other hand, a CFM Review would place emphasis on the quality of the actual practical audit work conducted by your Firm / Inspection, during which one to two of your completed audit files would be chosen and checked for significant and repetitive errors or any isolated audit deficiencies, which is exactly why a monitor review should be timely performed and is essential so that you can rectify possible deficiencies from the CFM report’s recommendations as early as possible!

In the audit file selection process of a CFM review, some specific engagements would be more common in being selected by the monitor reviewer for review, yet the general idea behind the selection is with regards to its engagement risk. These areas may include but are not limited to:

- Clients who are public-interest entities;

- Licensed corporations such as SFC-regulated entities, for example those that engage in asset management and, dealing and advising on securities;

- Insurance brokers that are regulated by the Insurance Authority;

- Group audits involving external component auditors;

- Newly accepted clients with audit work required on opening balances;

- Clients with a relatively complex timing of revenue recognition;

- Presence of inventories and / or financial instruments.

Combining all the factors above, we would be able to identify the areas that the HKICPA pays extra attention to and be vigilant about this. Hence, preparing for a inspector would revolve around performing decent quality audit work, especially in high-risk areas and of course exercising extra prudence with regards to the aforementioned engagements.

If you are interested in knowing more about our common findings, please kindly schedule an appointment with EQC Advisory and let us conduct a monitor review exercise with you. As mentioned in our website, EQC Advisory also offers practical audit training programs, hence we would humbly recommend a monitor review beforehand as your first step in allowing you to identify possible areas of deficiencies in order for you to best manage your working inspections.

Why does your inspection need a

Monitoring Review?

As mentioned above, HKSQM 1 requires monitoring reviews to be performed regularly, and are required to be submitted during AFRC Inspections. They act as a part of your inspection‘s system of quality control to identify deficiencies, so you may act to rectify them before they are officially identified by regulators, whom may then initiate investigations or enquiries into any non-compliance

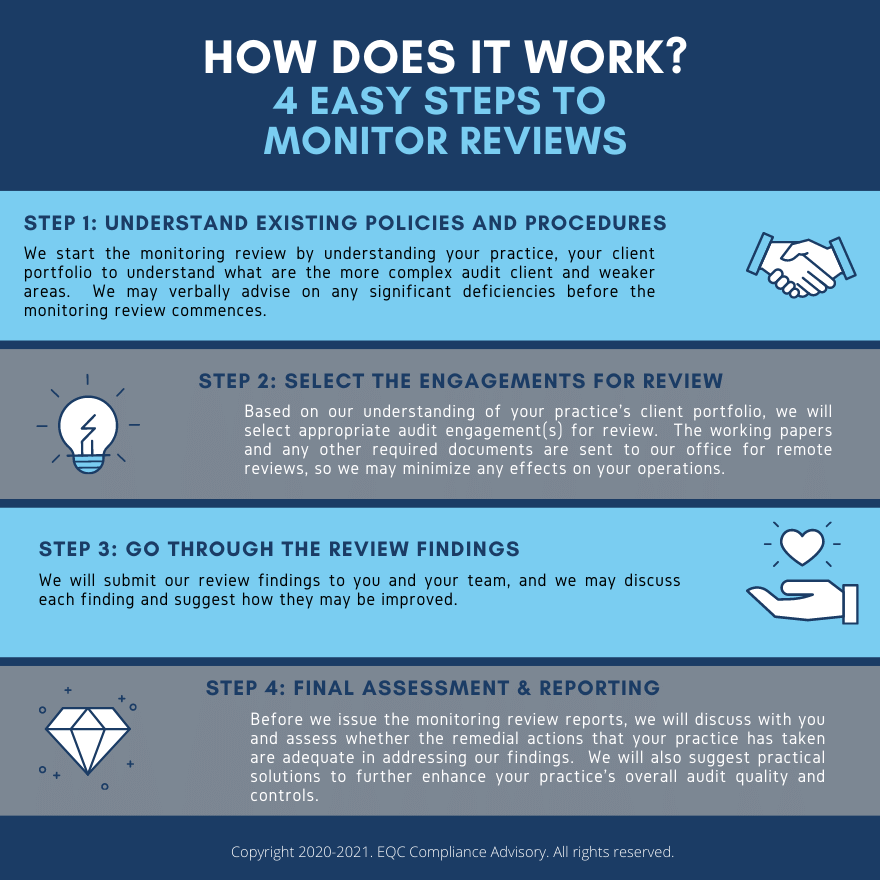

How do monitor reviews work?

The process of a monitoring review is simple and similar to any file review. The requested documents are sent to our office for review. Our findings will be sent to you for discussion, when we will recommend actions for your follow-up. Before we issue our monitoring reports, we will perform a final assessment to ensure proper remedial actions are taken by your inspection.

How much does it cost?

See our Monitor Review Promotions

The standard price of an external monitoring review, including 1 year’s ongoing policy monitor report, and 1 completed file review costs HK$30,000.

You may opt to engage us on our inspection preparation packages, where you may be entitled up to 25% off subject to the type of services included in the package of services.

FAQ's on Completed File Monitoring (CFM)

First of all, you should know that HKSQM 1 requires that a CFM Review is conducted on an audit / assurance engagement for each practitioner at least once every three years. However, we do insist that a CFM Review should be conducted at least on an annual basis for quality assurance, and to ensure that the quality of your Inspection’s audit work is improved from any deficiencies identified.

Human resources are your greatest assets. Employees’ salaries of up to hundreds of thousands, if not millions, of dollars are incurred annually, yet how much has your Inspection done to ensure that their work is up-to-standard and carried out with efficiency and effectiveness?

Regular health checks on completed engagements prepared and reviewed by each of your team members, especially audit semi-seniors / seniors / supervisors and managers would significantly help to ensure that their daily duties work towards protecting your Inspection. Inspection sustainability has become more important in the current unstable economic environment.

Quality assurance starts from practitioners effectively communicating to your employees, or even sub-contractors, on the importance of audit quality, and our review may act as one of your control points in identifying significant deficiencies that actually matter, and help to ensure that you are on your way to resolving them.

The number of engagements that should be reviewed depends on a number of factors, such as the number of independent audit employees your Inspection has, and how varied your potential deficiencies are across your audit engagements. For example, while your highest audit fee engagement may be a sizable HKFRS engagement with inventories or investments in subsidiaries / associates, a CFM review of this engagement may not be able to address other key audit issues, such as justification of a modified opinion, new client acceptance procedures, or procedures in a group audit.

We suggest that engagements with the following characteristics should be selected on a rotation basis every year, such that each of the following types of engagements is at least reviewed once every 3 years:

- Engagement using SME-FRS

- Engagement using HKFRS for PE

- Engagement using HKFRS / IFRS

- Engagements prepared and reviewed by different employees

- Engagements with the highest audit fees

- Regulated entities

- Engagements with inventories, financial instruments, intangible assets, going concern issues, or impairment risks

- Group audits with and / without external component auditors

- Clients that have been reviewed by a inspector in the past with multiple significant findings

- Engagements with modified audit opinion / disclaimer of opinion

- Subsequent engagements that have been reviewed by a monitor reviewer a few years ago

No, a CFM Review is not necessarily performed on-site. You only need to submit a scanned copy for all the required files for us, and we will conduct a desktop review from our office. We may then present our findings in a report, over Zoom or even in-person.

Your Inspection should provide us with a scanned copy of the audit working paper file / working file (including professional clearance letters, engagement letters, client / engagement acceptance documents, management-signed letters and confirmations) and the audited financial statements of the selected audit file.

You may also courier the selected audit file to our office in Central at 3/F., World Trust Tower, 50 Stanley Street, Central, Hong Kong

You should consider purchasing AP3.0 credits, so your team may use the completed audit programs as a pro-forma and also act as remedial actions to an external monitoring review.