Audit Program 4.0 - User Manual

5. Importing Data for Deliverables:

5.3 Mapping the Trial Balance & Ledgers

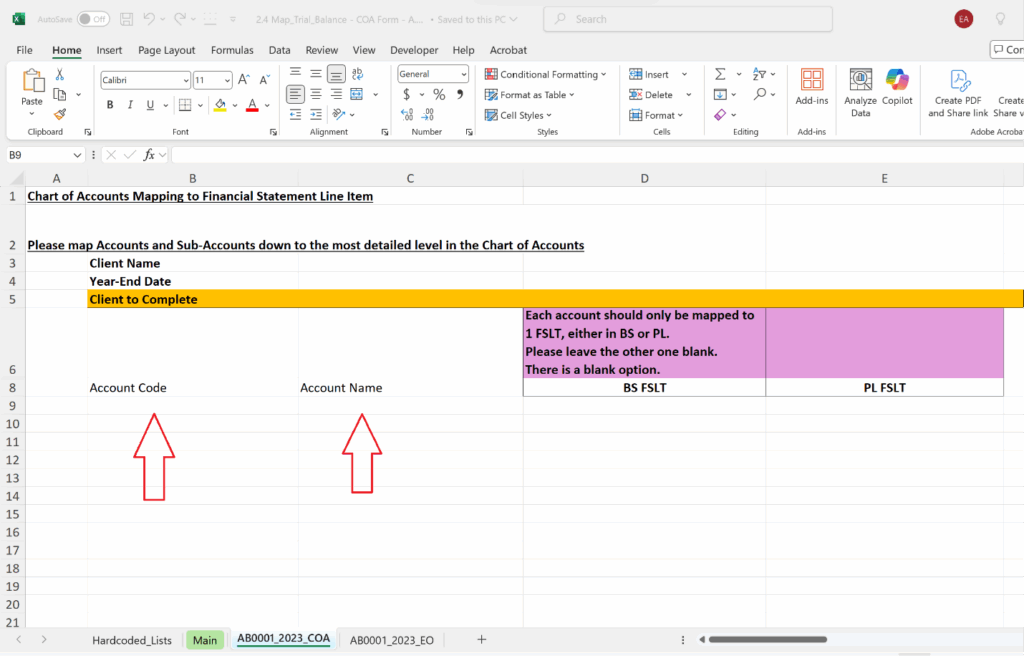

Complete the COA Mapping Form:

To successfully complete the COA form, the user shall obtain the audit client’s trial balance for the financial period. This section outlines the step-by-step process in mapping the trial balance to the respective financial statement line items (FSLT) within the COA Mapping Form.

A. Map the Trial Balance Accounts to Financial Statement Line Items:

1. Copy the Account Codes and Account Names from the Trial Balance

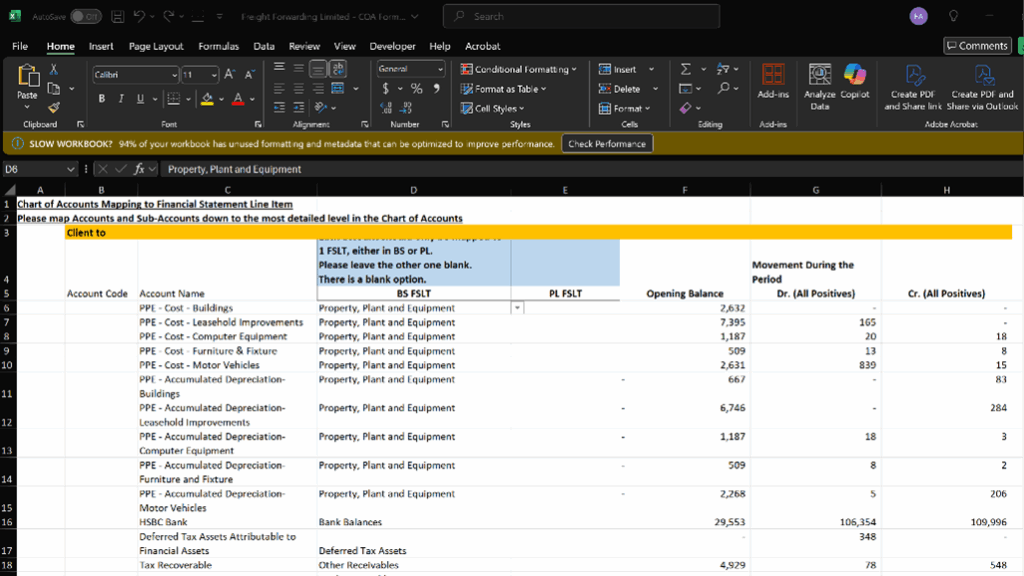

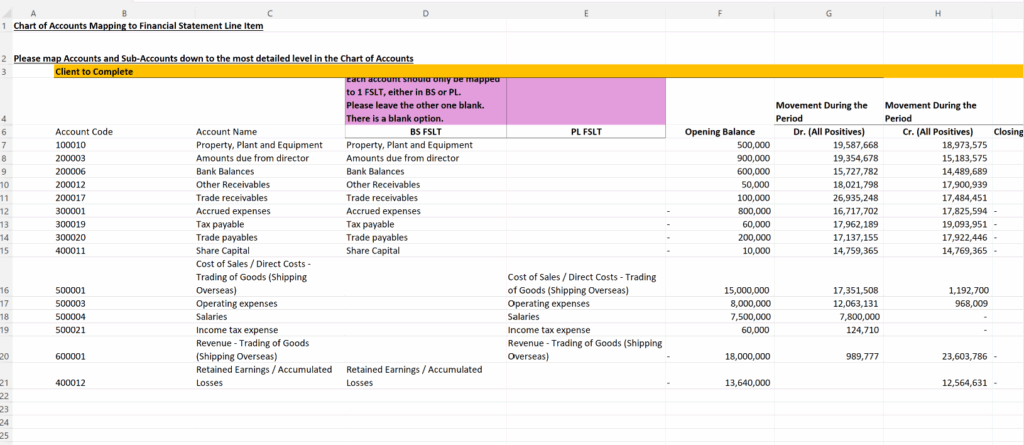

In the COA Mapping Form, complete Column B with the account code and Column C with the account name for each balance sheet account.

2. Select the Corresponding B/S Financial Statement Line Item:

In Column D, use the drop-down menu to select the applicable Balance Sheet Item to map the account.

Multiple accounts can be mapped to the same balance sheet item.

The drop-down menu only displays the Balance Sheet Items marked as “Yes” in the “Main” worksheet from “3. Complete Audit Report Data”.

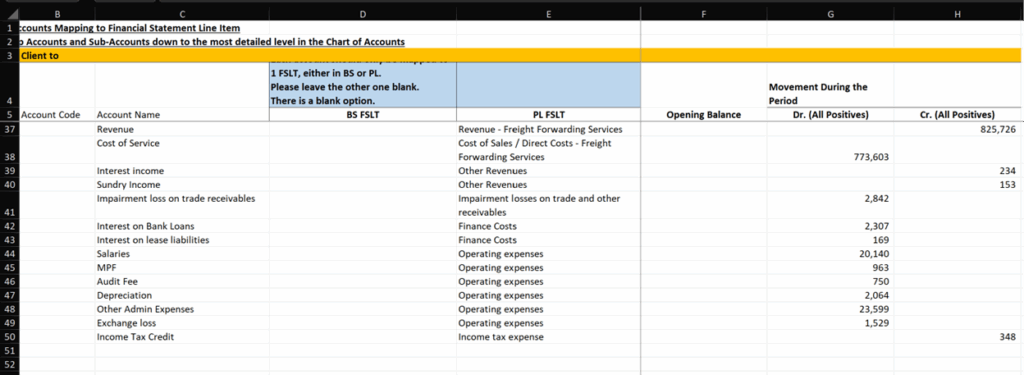

3. Select the Corresponding P/L Financial Statement Line Item:

In column E, use the drop-down menu to select the applicable Profit or Loss item to map the account.

4. Copy the Opening Balance and Movement During the Period from the Trial Balance:

Column F (Opening Balance):

- Enter the opening balance for the account.

- Use a positive number for debit balances and a negative number for credit balances.

Column G (Total Debits):

- Enter the total debits during the financial period as a positive number.

Column H (Total Credits):

- Enter the total credits during the financial period as a positive number.

B. Obtain the Ledgers in Excel File Formats from the Client

Obtain the Financial Ledgers in Excel file formats from the Audit Client. This may come in the form of a combined workbook with multiple worksheets, each worksheet representing the ledger of one account, or may be separate excel files. If the ledgers are in one combined excel workbook, you would have to separate the worksheets into separate excel files. Use our “Extraction Tool.xlsm” File to help to separate the worksheets into separate files.