Home / AP4.0 User Manual – Table of Contents / AP4.0 User Manual – 04. Preparation for Generation of Audit Files / AP4.0 User Manual – 04.4 Completing the Main Worksheet

Audit Program 4.0 - User Manual

4. Preparation for Generation of Audit Files:

4.4 Completing the "Main" Worksheet

The “Main” worksheet is the key input form used to control the entire audit process.

Accessing the "Main" Worksheet

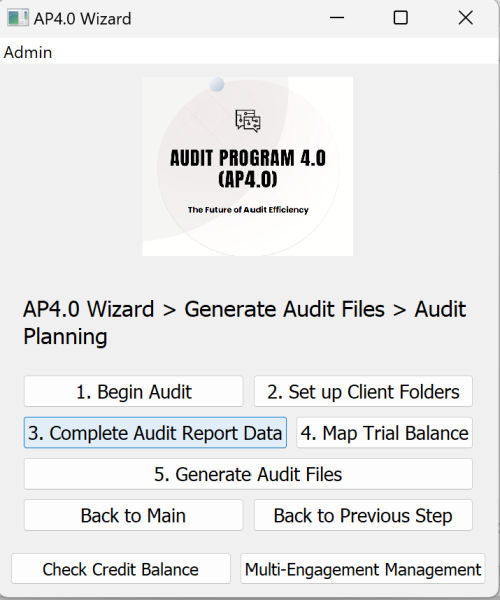

Return to AP4.0 Wizard Home Screen

– Click the “Back to Main” button to go to the AP4.0 Wizard Home Screen.

Navigate to Step 2

– From the dropdown menu, select “Step 2: Generate Audit Files” and click “Next”.

Click the “3. Complete Audit Report Data” Button to complete the “Main” Worksheet

Completing the "Main" Worksheet

General Guidelines

- Always start entering data from row 4.

- Each row represents one audit engagement.

- Complete the fields for each row from Column B onwards.

- The Client ID in column A is automatically generated by the program

Field-by-Field Instructions

Columns F to M (AP4.0 Functions)

- Enter “Yes” in columns F to I, if you wish to generate Audit Programs / Audit Work Papers for the first time

- Enter “Yes” in column L, if you wish to re-generate Audit Program / Audit Work Papers, after putting through audit adjustments.

- Enter “Yes” in column M, if you wish to re-generate Audit Program / Audit Work Papers, after putting through final client late adjustments.

- Enter “Yes” in column J, if this is not the first year’s audit using the Audit Program, and you wish to roll over prior year’s Finalized Audit as comparatives. (Note: Only applicable when prior year’s audit has completed running “Finalize materiality” i.e. Column M.)

Column T (Professional Clearance Date / Sanction Screening Date):

- Enter the date of the professional clearance letter received from the ex-auditor for new clients.

- Alternatively, use the date of the initial sanction screening for simplicity.

Column U (Engagement Letter Date):

- For new clients: Enter the date the engagement letter is signed.

- For recurring clients: Enter the date the audit team decides to commence the audit.

- Ensure this date is after the date in Column T.

Column V (Date of Audit Planning):

- Enter the date when audit planning is prepared.

- Ensure this date is after the date in Column U.

Column W (Field Audit Commencement Date):

- Enter the start date of the field audit.

- Ensure this date is after the date in Column V.

Column X (Subsequent Event Procedures Date):

- Enter the date up to which subsequent event procedures are performed.

- For consistency, use a month-end date that is before the audit report date (e.g., 31/12/YYYY).

Column Y (Audit Report Date):

- Enter the date of the audit report.

Column AA (Archive Due Date):

- This should be calculated as 60 days from the audit report date (Column Y).

Column Z (File Archive Date):

- Enter the date when the audit file is archived.

- Ensure this date is between the audit report date (Column Y) and the archive due date (Column AA).

Columns AB to AD (Financial Data):

- Enter the preliminary sales, profit/(loss) before tax, and total assets for the audit client.

- Note: You may change these financials at a later date by selecting “Revise Materiality” / “Finalize Materiality” when there are audit adjustments / late adjustments. (See Section 4.1 Above).

Columns AE to AM (Dropdown Selections):

- Use the dropdown menus to provide the most appropriate answers based on the engagement.

Columns AN and AQ (Principal Activities):

- Enter the principal activities of the audit client as described in the directors’ report:

- Column AN: Enter the first principal activity.

- Column AQ: Enter the second principal activity, or input “N/A” if there is only one.

- Use the “Search for Principal Activities” worksheet to find the closest match for the client’s activities.

Columns AO/AP and AR/AS (Industry Codes):

- For each principal activity, use the “Search for Principal Activities” worksheet to find the closest matching industry.

- If no exact match exists, select the closest resembling industry.

Columns AU to AZ (Key Accounting Estimates):

- Select up to 6 key accounting estimates using the dropdown menus.

- Use the “Search for Acct. Est.” worksheet for guidance.

- If fewer than 6 estimates, input “0. N/A” in the remaining columns.

Column BA (Number of Double Entries):

- Enter an estimate of the total number of double entries during the financial period.

- A rough estimate, rounded to the nearest hundred or thousand, is acceptable.

Columns CU to CW (Inventory Details):

- Complete these columns only if Column CT indicates that inventory is present.

- Otherwise, select “N/A” from the dropdown menu.

Columns BC to FD (Financial Statement Line Items / Disclosures):

- Use “Yes” or “No” to indicate whether the audited financial statements include specific account balances or transactions.

- Note: If this is not the first year that you are using the Audit Program for the same client, you may rollover and the program would automatically help to pre-complete these columns based on prior year’s data.

Column FE (Name of Directors):

- Enter the names of all directors.

- If there is more than one director, use Alt + Enter within the cell to separate their names.

- For corporate directors, enter the name of the individual attending planning meetings.

Final Notes

- Ensure data is entered accurately, as errors may cause issues during the generation of audit programs.

- Save the completed worksheet and proceed to the next steps for mapping the trial balance.