Latest Updates of AP3.0?

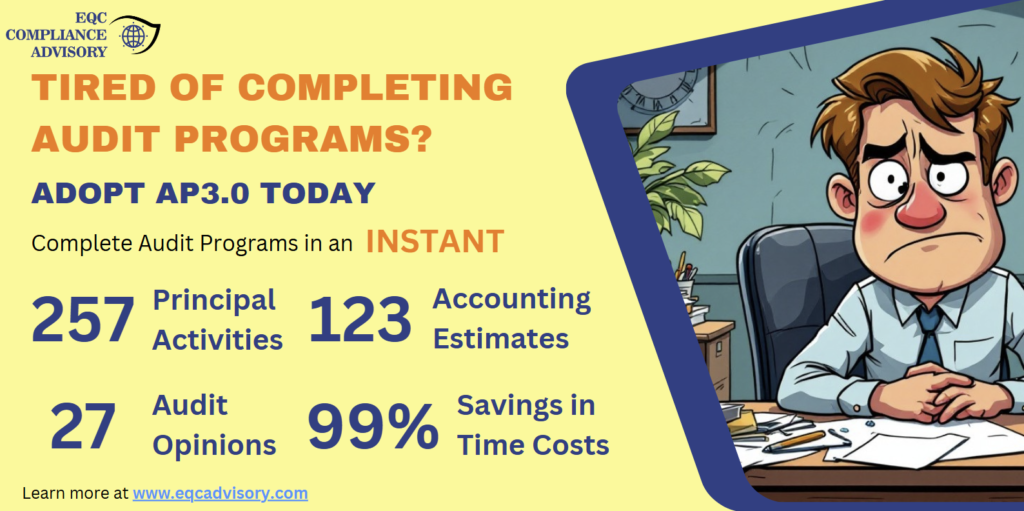

AP3.0 features 257 principal activities and 123 accounting estimates, ensuring an even more tailored experience. These enhancements are specifically designed to reflect the business and accounting practices prevalent in Hong Kong, providing your firm with the most relevant and effective audit programs available. Generate completed audit programs using the HKICPA-2022 version of APM’s and adopt the latest technologies in Language-based generative artificial intelligence to quickly comply with the latest AFRC Inspection expectations!

No installation fees, no program license fees. Purchase credits as you go.

Newly Added Principal Activities:

Retail and Shops:

- Electronics Stores

- Fashion Boutiques

- Jewellery Shops

- Watch Retailers

- Cosmetics and Beauty Stores

- Traditional Chinese Medicine Shops

- Supermarkets

- Convenience Stores

- Health Food Stores

- Bakeries

- Wet Markets (selling fresh meat and produce)

- Toy Stores

- Bookstores

- Stationery Shops

- Sports Equipment Stores

- Footwear Retailers

- Eyewear Stores

- Mobile Phone and Accessories Shops

- Home Appliance Retailers

- Furniture Stores

- Home Decor Shops

- DIY and Hardware Stores

- Flower Shops

- Pet Stores

- Tea Shops

- Wine and Liquor Stores

- Specialty Food Shops (e.g., cheese, chocolate)

- Maternity and Baby Stores

- Children’s Clothing Shops

- Lingerie Stores

- Handbag and Accessories Boutiques

- Art Galleries

- Antique Shops

- Musical Instrument Stores

- Record Stores

- Camera and Photography Equipment Shops

- Computer and Software Stores

- Car Dealerships

- Motorcycle and Scooter Shops

- Bicycle Shops

- Lighting Stores

- Bedding and Linen Shops

- Carpets and Rugs Stores

- Cookware and Kitchenware Shops

- Watch Repair and Services

- Tailors and Dressmaking Shops

- Souvenir and Gift Shops

- Leather Goods Stores

- Specialty Tea and Coffee Shops

- Seafood Markets

- Herbal Tea and Supplements Stores

- Skateboard and Surf Shops

- Outdoor and Camping Gear Stores

- Art Supplies Stores

- Discount Stores

- Thrift Shops

- Wedding Dress Boutiques

- Formal Wear Stores

- Perfume Stores

- Travel Goods and Suitcase Shops

- Toy and Hobby Shops

- Video Game Stores

- Second-Hand Bookshops

- Party Supplies Stores

- Cigar and Tobacco Shops

- Tattoo and Piercing Studios

- Gourmet Shops

- Shops Selling Cultural and Ethnic Goods

- Religious Goods Stores

- Pop-Up Stores

- Concept Stores

- Dollar Shops

- Eco-Friendly Product Stores

- Nutritional Supplements Stores

- Ice Cream and Dessert Shops

- Fast Fashion Retailers

- Luxury Brand Boutiques

- Shopping Malls with Various Retail Outlets

- Department Stores

- Duty-Free Shops

- Fabric and Textile Stores

- Craft Stores

- Bridal Shops

- Yarn and Knitting Supplies Stores

- Acupuncture and Massage Supply Stores

- Board Game Cafés and Shops

- Pharmacies

- Opticians

- Pawn Shops

- Gold and Precious Metals Dealers

- Auction Houses

- Coin and Stamp Collectible Stores

- Comic Book Shops

- Vintage Clothing Stores

- Printing and Copy Shops

- T-shirt Customization Shops

- Snack and Candy Stores

- Delicatessens

- Consumer Electronics Chains

- Asian Groceries

Newly Added Accounting Estimates:

Revenue Recognition:

- Allowance for doubtful accounts (bad debt provision)

- Percentage of completion for long-term contracts

- Revenue recognition on service contracts

- Lease term and discount rate for lease liabilities

- Estimated earning rates for deferred revenue

- Measurement of revenue based on royalty and licensing agreements

- Recognition of revenue from milestone payments

- Assessment of variable consideration for revenue recognition

- Measurement of non-refundable deposits for sales

- Estimation of the standalone selling price for distinct performance obligations

- Recognition and measurement of revenue from consignment sales

- Measurement of progress towards complete satisfaction of a performance obligation

- Measurement of deferred revenue from customer financing

- Recognition of revenue from advertising services

- Estimation of significant financing components in contracts with customers

- Measurement of income and expenses on a cash basis for certain types of revenue recognition

- Measurement of the timing of satisfaction for performance-based payments

- Fair value of financial instruments

- Valuation of investment properties

- Valuation of private equity investments

- Valuation of derivatives

- Fair value of biological assets

- Fair value of assets held for sale

- Fair value of contingent liabilities

- Valuation of redeemable financial instruments

- Fair value of customer relationships acquired in a business combination

- Fair value estimates of equity investments without active market

- Fair value of unquoted equity securities

- Fair value of intangible assets acquired in a business combination

- Allocation of fair value to separable and non-separable components of a financial instrument

- Estimation of fair value under the equity method for joint ventures and associates

- Estimation of fair value of assets and liabilities in a net asset acquisition

- Measurement of the fair value of an indemnification asset

- Measurement of the fair value of a liability for a host contract with an embedded derivative

- Fair value measurement of assets acquired in a non-monetary exchange

- Depreciation of property, plant, and equipment

- Amortization of intangible assets

- Impairment of assets

- Useful life of tangible and intangible assets

- Residual values of assets

- Revaluation of property, plant, and equipment

- Estimation of useful lives of software and technology

- Allocation of goodwill to cash-generating units for impairment testing

- Estimation of the recoverable amount of cash-generating units

- Valuation of future cash flows for impairment testing

- Estimation of salvage values of assets

- Measurement of the fair value of a reporting unit in goodwill impairment testing

- Estimation of future operating results for impairment testing

- Estimation of the amount and timing of future cash flows for long-lived assets

- Expected credit losses on financial assets

Fair Value Measurement:

Asset Valuation and Impairment:

Newly Added Principal Activities (Continued):

Non-Retail Businesses:

- Banking and Finance Companies

- Investment Firms

- Insurance Companies

- Real Estate Agencies

- Property Management Services

- Law Firms

- Accounting and Audit Firms

- Consulting Companies

- Marketing and Advertising Agencies

- Public Relations Firms

- Shipping and Logistics Companies

- Freight Forwarding Services

- Import and Export Businesses

- Trading Companies

- Manufacturing Plants

- Textile and Garment Factories

- Electronics Assembly Firms

- Food Processing Companies

- Corporate Training Providers

- Event Planning Services

- IT and Software Development Companies

- Web Design and Development Agencies

- Graphic Design Studios

- Architecture and Design Firms

- Engineering Consultancies

- Construction Companies

- Interior Design Services

- Medical Clinics

- Dental Practices

- Private Hospitals

- Traditional Chinese Medicine Clinics

- Health and Wellness Centers

- Physiotherapy Clinics

- Fitness Centers and Gyms

- Yoga and Pilates Studios

- Martial Arts Schools

- Dance Studios

- Private Education Providers

- International Schools

- Language Schools

- Tutoring and Exam Preparation Centers

- Universities and Higher Education Institutions

- Research and Development Labs

- Biotechnology Companies

- Pharmaceutical Companies

- Environmental Consultancies

- Waste Management and Recycling Services

- Energy Providers

- Oil and Gas Companies

- Renewable Energy Companies

- Venture Capital and Private Equity Firms

- Financial Technology (Fintech) Startups

- Cybersecurity Firms

- Data Analysis and Big Data Companies

- Telecommunications Providers

- Mobile App Development Companies

- Film Production and Post-Production Houses

- Recording Studios

- Broadcasting Companies

- Publishing Houses

- Translation and Localization Services

- Legal Translation Services

- Courier and Delivery Services

- Professional Cleaning Services

- Pest Control Services

- Landscaping and Gardening Services

- Floral Designers and Event Decorators

- Catering Services

- Food Distribution Companies

- Commercial Kitchen Suppliers

- Hotel and Hospitality Businesses

- Travel Agencies

- Tour Operators

- Aviation Services and Airlines

- Marine Services and Boat Charters

- Private Equity and Investment Management

- Corporate Finance Advisors

- Human Resources Consulting Firms

- Recruitment Agencies

- Employment and Staffing Services

- Co-working Space Providers

- Business Incubators and Accelerators

- Industry Associations and Trade Organizations

- Non-Governmental Organizations (NGOs)

- Charitable Foundations

- Religious Organizations

- Art Studios and Galleries

- Performing Arts Theaters

- Musical Performance Venues

- Sports Clubs and Associations

- Professional Services Automation

- Business Process Outsourcing Companies

- Call Centers

- Legal Process Outsourcing Services

- Supply Chain Management Firms

- Quality Control and Certification Companies

- Compliance and Regulatory Consulting

- Risk Management Consultants

- Intellectual Property Firms

- Notary Public Offices

Newly Added Accounting Estimates (Continued):

Inventory:

- Inventory obsolescence reserve

- Measurement of the cost of sales

- Allocation of overheads to inventory valuation

- Provisions for slow-moving inventory

Provisions, Contingencies, and Liabilities:

- Warranty provisions

- Provisions for restructuring costs

- Provisions for legal disputes and litigation

- Provisions for onerous contracts

- Employee benefit obligations (pensions, post-employment benefits)

- Measurement of decommissioning liabilities

- Estimated costs to settle asset retirement obligations

- Measurement of insurance contract liabilities

- Recognition and measurement of provisions for warranties

- Measurement of the discount rate for pension liabilities

- Provisions for environmental remediation costs

- Measurement of loyalty program liabilities

- Provisions for rebates and discounts

- Contingent consideration in a business combination

- Measurement of non-controlling interests

- Measurement of consideration paid in a business combination

- Allocation of purchase price in acquisitions

- Assessment of control in a business combination

- Valuation of indemnification assets

- Share-based payment valuations

- Valuation of stock options under employee share schemes

- Estimation of market-based employee compensation

- Estimation of bonus accruals under incentive programs

- Estimation of forfeiture rates for share-based payments

- Deferred income tax assets and liabilities

- Loss carryforwards utilization

- Estimation of the outcome of pending tax disputes

- Valuation of intercompany transactions for transfer pricing

- Capitalization of borrowing costs

- Capitalization of development costs

- Valuation of virtual currencies or cryptocurrencies

- Valuation of trade secrets or proprietary technology

- Assessment of hedge effectiveness for hedging instruments

- Valuation of rights of use assets under leases

- Measurement of income and expenses in foreign currency transactions

- Estimation of sublease income

- Determination of the discount rate for deferred consideration

- Valuation of preferred shares

- Valuation of convertible notes

- Valuation of collateral held against loans

- Determination of finance or operating lease classification

- Estimation of the extent of progress towards completion of service concession arrangements

- Valuation of a residual guarantee in a lease

- Valuation of the expected life of customer contracts

- Valuation of the exercise price of warrants

- Measurement of variable lease payments

Business Combinations and Investments:

Share-based Payments and Employee Compensation:

Taxation:

Others:

Applicable to AP3.0 Advanced & AP3.0 All-Inclusive:

In addition to the section-specific summary pages in sections E to X, we will also be generating additional consolidated worksheets for the following that will help streamline your audit processes:

- Consolidated Audit Request List

- Consolidated Audit Procedures List

- Consolidated Management Representation Letter

- Consolidated Significant Accounting Policies

We will also be labelling the audit procedures by type of procedures, and generating some templates for test of details audit procedures that are generated for that specific financial statement line item.

Applicable to AP3.0 Advanced & AP3.0 All-Inclusive:

- Testing templates will be generated for selected balance sheet and profit & loss financial statement line items based on the selected financial reporting framework.

- Component Materiality will be determined with justifying audit documentation on the method of determination. The submission form will be amended to allow input of the consolidated sales, consolidated total assets, consolidated total liabilities, consolidated equity and consolidated profit / losses before tax, and to link audit programs between subsidiaries and the audit program of the consolidated financial statements.

We have decided to implement monthly upgrades to AP3.0 effective immediately, and we will publish our monthly upgrades on a notifications board that only subscribed users have access to. These upgrades will not only be limited to adding more options in the submission forms, but will be new functionalities, so that the audit programs generated by AP3.0 will provide even more value to you than when you initially engaged us!

We will be generating working paper templates for some selected tests of details on most financial statement line items, and the design of these test of details working paper templates will be generated based on the supporting documents specified in the audit procedures within the program!

From then on, any audit working program generated will also have audit testing templates, and sampling sheets!

June 2023 - Launch Event Photos

Save 99.9998% of your time costs now!

EQC Audit Program 3.0 can help you reduce error rates , and here are 8 Pain Points that the Service may help address and we explain why your practice should engage us for Audit Program 3.0.

Pain Point 1: Talent Shortage

Problem 1 and Solution 1:

The talent exodus due to strict COVID-related regulations and emigration waves in recent years has left many SMEs in Hong Kong suffering from a high staff turnover rate of 20% per annum or being significantly understaffed. The audit industry is particularly affected, as many young talents are unwilling to enter this field due to its mundane, repetitive nature and long working hours.

Audit Program 3.0 addresses the talent shortage issue by automating many mundane and repetitive tasks, making the audit process less labor-intensive and more efficient. This can help attract young talent to the industry by reducing the long working hours typically associated with audit work, making the profession more appealing and less monotonous. Automation also allows CPA firms to maintain high-quality services even with limited staffing resources.

Pain Point 2: SMP's Limited Access to Competent Staff

Problem 2 and Solution 2:

Small-and-medium sized practices (SMPs) in the audit industry face a constant challenge in recruiting competent staff, as young and experienced talents are less likely to join these firms due to the lack of career-building opportunities. This leaves SMPs with limited options for recruitment, often having to settle for inexperienced and less-educated candidates.

By streamlining the audit process and eliminating the need for extensive industry-specific knowledge, Audit Program 3.0 enables SMPs to better utilize their existing staff and reduce the pressure to recruit highly experienced auditors. The automation provided by the service allows even less experienced auditors to perform high-quality audit work, bridging the competence gap and making SMPs more competitive in the market.

Pain Point 3: Labor-Intensive Audit Work

Problem 3 and Solution 3:

With new auditing standards being released almost every year, auditors have more standards to comply with, increasing the workload and resulting in labor-intensive audit work. This includes many mundane, repetitive tasks that can lead to long working hours, low profitability and recoverability on audit projects, and errors due to exhaustion and boredom when completing audit programs.

Audit Program 3.0 tackles labor-intensive audit work by automating a significant portion of the audit process, including risk assessments, designing audit procedures, and generating completed audit programs. This reduces the workload on auditors, allowing them to focus on more value-added tasks, minimizing the risk of errors due to exhaustion and boredom, and increasing the overall efficiency and profitability of audit projects.

Pain Point 4: Industry-Specific Knowledge Gap

Problem 4 and Solution 4:

When auditing clients in unfamiliar industries, audit efficiency is often significantly reduced, as auditors lack the necessary knowledge and experience to understand the client’s industry. This can be challenging, as auditing standards require auditors to document industry-specific business processes, revenue recognition, and workflows. CPA firm owners are also faced with the difficulty of choosing to serve only specific client industries.

Audit Program 3.0 helps bridge the industry-specific knowledge gap by providing guidance on internal controls, revenue recognition, and cost of sales for 257 client industries. This allows auditors to quickly gain an understanding of unfamiliar industries and ensures that audit documentation is accurate and compliant with auditing standards. The service acts as a technical hub for auditors, significantly improving audit efficiency in industries where they may have limited experience.

Pain Point 5: Reviewer's Challenges

Problem 5 and Solution 5:

Reviewing completed audit programs can be a daunting task, as each set can consist of up to 300 pages of information, much of which is similar but slightly different. Reviewers face significant challenges in efficiently and effectively reviewing these audit programs prepared by junior auditors.

By automating the completion of audit programs, Audit Program 3.0 ensures consistency and compliance with auditing standards, allowing reviewers to focus their attention on high-risk areas.

This reduces the time and effort required for reviewing large volumes of information, and ensures that the quality of audit programs is maintained even in lower-risk areas.

Pain Point 6: Regulatory Pressure

Problem 6 and Solution 6:

With the Accounting Financial Reporting Council (AFRC) taking over the regulatory oversight of Hong Kong CPA practices from the HKICPA, practitioners in the audit industry face increased regulatory pressure and scrutiny. Ensuring compliance with these heightened regulations is more important than ever.

Audit Program 3.0 helps alleviate regulatory pressure by ensuring that the audit process complies with all Hong Kong Standards on Auditing, including the latest HKSQM 1 and 2. The automation provided by the service ensures consistent compliance with these standards and reduces the risk of non-compliance, allowing CPA firms to confidently navigate the heightened regulatory environment.

Pain Point 7: New Review Procedures in AFRC Inspections

Problem 7 and Solution 7:

Under the AFRC’s new regulatory regime, there is an increased emphasis on having an effective system of quality management in place. Compliance experts speculate that the AFRC will place more focus on the timing of working paper preparation and review during practice inspections.

With Audit Program 3.0, CPA firms can generate audit programs and working papers covering all substantive audit procedures ahead of time once the management accounts are received from the client, enabling auditors to only focus on the judgmental areas.

Late client adjustments and audit adjustments can be added to working papers by simply adding them to our templates, and all working papers can be updated by a click of a button!

This reduces the risk of being caught modifying working papers after archive dates, addressing the concerns around new review procedures under the AFRC’s regulatory regime.

Pain Point 8: Limitation of Traditional Templates

Problem 8 and Solution 8:

Traditional templates provided by CPA firms or consultancy firms for auditors to use in completing audit engagements have their limitations. Auditors may choose the wrong templates or omit important papers, and they may also lack the knowledge to properly complete or customize these templates.

Audit Program 3.0 goes beyond traditional templates by not only providing the template but also completing illustrative model answers specific to each audit engagement. Working papers are completed based on the imported financial information, and templates used for importing financial information are so user friendly that even untrained client’s accounting team can complete them.

This ensures that the right templates are used and that auditors know how to customize them to suit the particular circumstances of the engagement. The service eliminates the limitations of traditional templates, allowing CPA firms to streamline their audit process and maintain compliance with the latest accounting and auditing standards.

Six More Reasons to Use AP 3.0

i. Resolves the Most Common Practice Review Findings

Over the past 3 years, EQC has been constantly improving our documentation in addressing common practice review findings, and we can confidently confirm that our Audit Program 3.0 can effectively address TEN of the most prevalent audit deficiencies that are commonly found in audit programs across the entire SMP industry.

-

- Lack of understanding of the internal controls on key business processes.

-

- Lack of assertion-level, financial statement-level, inherent and control risk assessments.

-

- Lack of fraud risk considerations and inadequate procedures on management override of controls.

-

- Lack of assessments and evaluation of key accounting estimates.

-

- Lack of customized audit procedures tailored for your specific industry, when applying a specific financial reporting framework, such as SME-FRS, HKFRS for PE, or HKFRS.

-

- Lack of considerations of the impact of new accounting standards on opening balance and current year financial statements.

-

- Lack of documentation on work done on going concern considerations.

-

- Lack of documentation to justify the use of a specific type of audit opinion, such as material uncertainty paragraph, qualified opinion, adverse opinion or disclaimer of opinion.

-

- Lack of considerations of prior year’s modified audit opinion, and how it affects your client acceptance and engagement continuance procedures.

-

- Lack of audit scoping for significant components of group audits, and insufficient documentation on the proper determination of group and component materiality.

ii. Instant Generation of APM

Now you are familiar with the problems it resolves, you would probably be wondering if we have the manpower the complete so many audit programs. Upon the purchase of AP3.0 credits, you are granted with free installation of the software on one of your workstations. The generation of completed audit programs does not require online access, so we do not have access to your client / engagement information, and the generation is almost instant.

iii. Save 99.9998% of your Time Costs

Through our determination on digital transformation, we have been able to lower the cost to levels significantly below the equivalent time-cost of a typical audit junior.

The lowest cost of a qualified auditor who can write effective audit documentation on internal controls, revenue recognition processes, evaluation of key accounting estimates, etc. would cost around HK$30,000 per month before annual leaves, bonuses and benefits. To write one of these documentation, it may take 20-30 minutes, equivalent to a cost of HK$57 – 85.

Our AP3.0 of the program provides in excess of 245 million permutations of customized model answers, at a cost as low as HK$300 per completed audit program for your audit engagement, effectively reducing the cost to infinitely close to zero per written answer., effectively saving up to 99.9999% of your time costs.

iv. Technology Helps to Eliminate Human Errors

Human mistakes arising from carelessness is always inevitable. If you have previously purchased / encountered working paper templates available in the market, you would realize that it would almost be an impossible feat to digest the 1000-page long audit practice manual to ensure that the documented procedures have indeed been carried out in your working paper files.

Any inconsistencies between your firm’s audit practice manual and the archived working papers would be undisputable indicator of weakness in the firm’s engagement performance procedures.

Our AI-based Audit Program 3.0 helps to eliminate any inconsistencies between the 200-page programs, your audit schedules sample size calculations, your working papers, and your audited financial statements, which would also significantly reduce your costs in file reviews. Your time can thus be re-invested into areas that commercially matter to your business.

v. Over 245 Million Permutations

Audit Program 3.0 offers the following options when generated the illustrative completed audit program!

1. Financial Reporting Framework: 3 choices

2. Financial Statement Line Items: 96 choices

3. Principal Activities: 257 choices

4. Accounting Estimates: 123 choices

5. Audit Opinions: 27 choices

There are over 245 million possible permutations for your program with these parameters and choices. That is real customization at a very low cost!

vi. Use for Consultancy Services, Internal Training and More!

Who said that the Audit Program 3.0 can only be used for your practice’s audit and assurance services?

Imagine your client engaged you for internal control consultancy prior to a planned IPO, and your client operates in a specific industry that you are unfamiliar with. All you have do is, use 1 of your purchased credits to generate an Audit Program specific to your client’s industry, and you will have pre-written internal controls specific to that industry!

Imagine your client needs to improve their internal controls to address previous financial statement level or fraud risks, and needs to write a comprehensive internal control manual covering all business processes of the company, from sales, marketing, human resources, disbursement claims, management of investment properties, property plant and equipment, making investment decisions, managing loans, and registering patents and trademarks. Yes! We cover the internal controls of all these processes and much more!

Imagine you have a network of potential clients in regulated industries, such SFO regulated, brokers regulated under Insurance Ordinance, or Solicitors’ Firms under the Accountants’ Reports Rules, and Law Society of Hong Kong. Now you can generate audit programs for each of these industries, and have customized list of audit procedures when preparing the compliance reports or accountants report of these engagements, significantly lowering your regulatory risks!

Imagine you are going through a AFRC inspection, and you are asked to elevate your practice’s audit quality in auditing specific account balances, or when applying specific new accounting or auditing standards. Now with Audit Program 3.0, you can create your own in-house training materials using our generated model answers, and use these training decks as evidence of remedial actions taken by your practice!